Vietnam needs regulation of digital, virtual assets

Latest

|

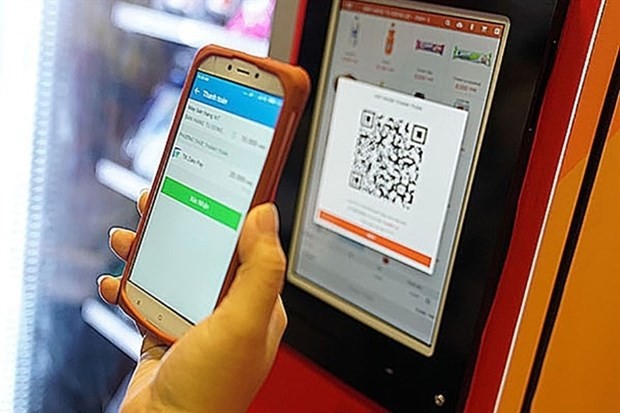

| Industry 4.0 was driving a boom in digital and virtual assets, requiring regulations to be raised to ensure its on-track development and management of asset ownership rights. (Photo: laodong.vn) |

Currently, digital and virtual assets have not been recognised as property in Vietnam.

Experts said that the existing legal framework of Vietnam was encountering difficulties in tolerating new types of assets in the Industry 4.0 era.

Le Thuy Nga from the Institute of Legal Science pointed out that Vietnam had not had a legal corridor to identify the owners and transactions of assets on new technology applications.

This causes uncertainty in protecting individuals' rights or interests in the holding, transferring, and inheritance of crypto-assets, especially in cases of protection against theft or expropriation.

The Law on Corporate Income Tax and the Law on Personal Income Tax were not applicable for transactions of crypto assets, Nga said.

Due to the lack of a clear legal framework, tax authorities could not collect taxes on investing and trading in crypto assets, while it also confused managing other sectors such as opening cryptocurrency exchanges or launching initial coin offerings to raise capital.

Nga said that the lack of regulation, together with low awareness of residents about virtual assets and cryptocurrency, also recently led to an explosion of fraudulent activities. The confusion between the concepts of cryptocurrency and digital assets also caused problems in State management.

From a legal perspective, Nga said that the cryptocurrency was not recognised as a legal currency and payment method in Vietnam, adding that it was necessary to have regulations that clearly distinguish cryptocurrency from electronic assets.

Experts said that the biggest legal problem with asset ownership in the context of Industry 4.0 lay in the fact that there were no rules that clarify digital assets.

At the third session of the 15th National Assembly in June, Governor of the State Bank of Vietnam Nguyen Thi Hong said that it was necessary to clarify electronic money, cryptocurrency and virtual assets.

Hong said that electronic money was an electronic store of monetary value on a technical device, adding that the decree about cashless payment was being amended to clarify this definition.

Like bitcoin, Governor Hong said, cryptocurrency and virtual assets have not been recognised as legal currencies issued by central banks. These currencies were only identified in specific communities such as gaming or technology.

Each country had a different way of managing virtual currency. In Vietnam, relevant ministries and agencies are studying the legal framework for cryptocurrency.