A banner year for Vietnam stocks: VN-Index closes 2025 with 41% rally

Latest

|

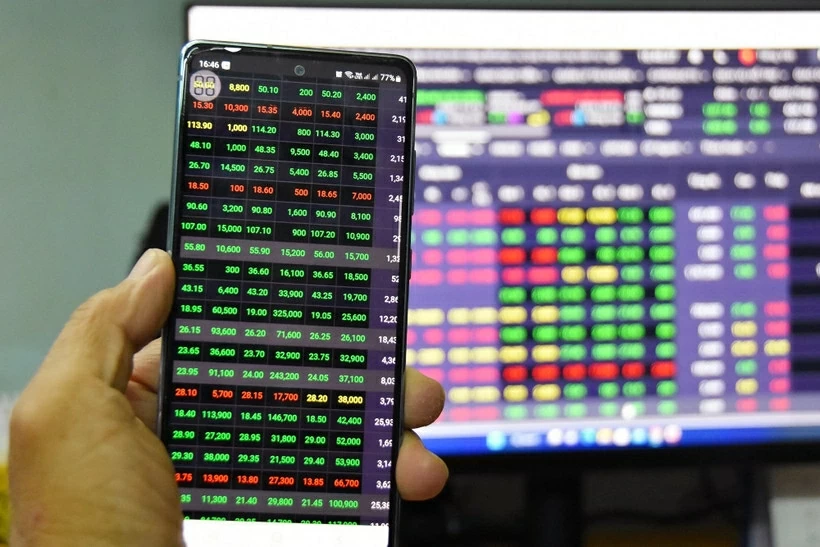

| The VN-Index on the Ho Chi Minh Stock Exchange (HoSE) hit 1,784.49 at the close of 2025, gaining nearly 518 points from the beginning of the year or approximately 41%. (Photo: CafeF) |

The Vietnamese stock market closed 2025 with strong but impressive volatility, as both indices and liquidity recorded historic milestones, reflecting the strong return of capital flows and renewed investor confidence.

At the close of the final trading session of 2025, the VN-Index, tracking the performance of the Ho Chi Minh Stock Exchange (HoSE), rose 17.59 points to 1,784.49, gaining nearly 518 points from the beginning of the year or approximately 41%.

About 704.5 million shares changed hands on the HoSE for nearly 22.35 trillion VND (849.8 million USD). The exchange recorded 134 gainers, 185 decliners, and 56 unchanged stocks.

On the Hanoi Stock Exchange, the HNX-Index fell 1.73 points to 248.77 points, with trading volume of more than 59.1 million shares and a value of nearly 1.3 trillion VND. The UPCoM-Index on the Unlisted Public Companies’ Market (UPCoM) edged up 0.22 points to 120.97, with liquidity exceeding 40.4 million shares, equivalent to 650.4 billion VND.

Looking at the whole of 2025, the Vietnamese stock market experienced many emotional swings. At one point, the VN-Index plunged to around 1,094 points due to a tariff shock, but then quickly rebounded, consecutively setting new historic highs and ending the year with an impressive gain of 517.71 points.

VIC of Vingroup and VHM of Vinhomes contributed the most to the VN-Index’s rise in 2025; while FPT of tech giant FPT, VCB of Vietcombank, and DGC of Duc Giang Chemicals exerted negative impacts on the index.

According to Maybank Investment Bank, the 2012-2025 period showed that the market typically performs positively in January, with an average return of about 4.4%, before gradually weakening in February and March. Large-cap stocks tend to move in tandem with the VN-Index and record strong gains in the first two months of the year, while mid- and small-cap stocks often break out later, accompanied by greater volatility and higher risk. This suggests that early 2026 opportunities are likely to continue favouring large-cap stocks, especially market-leading names.

Vietcap Securities notes that the VN-Index could potentially reach 2,033 points in 2026, representing an approximate 17% increase from the previous year. The primary drivers for this optimistic scenario are expected to be sustained high corporate profit growth and attractive market valuations.

VPBankS Research's 'Investment Outlook 2026' report indicates that macro-economic stability is projected to improve in this year. The quality of bad debts within the banking system has also seen improvement over the first nine months of 2025, sending positive signals about market prospects for 2026.

VPBankS predicts a target for the VN-Index of 2,087 points by the end of 2026, based on a targeted price-to-earnings (P/E) ratio of 16.5 times and an expected earnings per share (EPS) growth of 14.4% year-on-year.

Investors are focused on VN-Index valuation levels, which, as of December 25, traded at a P/E ratio of 15.8, 16% above the three-year average.

However, a report from MB Securities (MBS) offers a different perspective: excluding Vingroup stocks, the P/E ratio drops to 13.5, with a 2025 average of 12.2.

MBS said that any growth in the VN-Index, excluding Vingroup’s influence, will mainly come from core profit growth rather than inflated valuations.

They recommend a cautious P/E valuation range of 12.5-13 for 2026, maintaining a positive outlook for the first half, with the VN-Index potentially reaching 1,860 points.

Nevertheless, MBS anticipates mounting pressures in the second half of the year, stemming from new interest rate environments and their impact on market liquidity.

The cautious stance reflects the gradual effect of new rates on stock market liquidity. Additionally, some speculative capital is expected to return to the production sector as the real economy shows clear signs of recovery.

MBS expects the VN-Index to close at 1,670-1,750 points by the end of 2026, based on projected profit growth of 16-17% for listed companies.

| Vietnam rises in Global Innovation Index, leads in creative goods exports The 2025 Global Innovation Index (GII), recently released by the World Intellectual Property Organisation (WIPO), shows that Vietnam has made significant progress across multiple indicators, ... |

| Vietnam ranks 44th in Global Innovation Index 2025 by WIPO Vietnam has been ranked 44th out of 139 economies with an overall score of 37.1 in the 2025 Global Innovation Index (GII) released by the ... |

| Vietnam Dialogue 2025 drives economic cooperation between Vietnam, Germany, Europe WVR/VNA - The 'Vietnam Dialogue 2025' forum, held at the weekend in Frankfurt, brought together a large number of German and Vietnamese experts, scholars, and ... |

| 'Red Rain' closes Vietnamese Film Week in Paris The Vietnamese Film Week in Paris officially came to a close on December 12 evening with a special highlight as ‘Red Rain’ - a film ... |

| Ambassador hails 2025 as a milestone year in Vietnam–US relations VNA/WVR- 2025 was an incredibly significant year for Vietnam-US relations, marked by a series of major anniversaries and substantive advances across multiple areas of cooperation, ... |