FDI firms expand in Vietnam’s textile and garment industry

Latest

| TIN LIÊN QUAN | |

| Canada will be potential market for Vietnamese export garments | |

| Japanese capital continues pouring into textile and garment | |

Vietnam’s participation in the Comprehensive Partnership and Trans-Pacific Partnership Agreement (CPTPP) and the upcoming EU-Vietnam Free Trade Agreement (EVFTA) have prompted foreign producers to expand in the country’s textile and garment industry.

German-based Amann Group, which is among the world’s top three leading producers of high-quality sewing and embroidery thread, is expanding its network to Vietnam with a new factory being constructed in the central province of Quang Nam.

At the new production site, the group will produce around 2,300 tons of sewing thread per year, mainly for the manufacture of apparel and shoes. The first phase of the project is scheduled to commence in late July next year.

American developer of spider silk-based yarn Kraig Biocraft Laboratories Inc has also chosen Vietnam to scale up its spider silk commercialization efforts. The group is working with agricultural co-operatives in Quang Nam Province to set up a center for research and development of silk as well as grow mulberry to support spider silk.

|

| Vietnam is offered a big opportunity to increase textile and garment exports to the bloc’s markets. |

Korean giant Hyosung Corporation is also in the process of expansion in Vietnam. According to managing director of Hyosung Vietnam Company Limited, Yoo Sun Hyung, the company has invested some US$1.5 billion in Dong Nai province, but is still planning to expand its fiber manufacturing projects.

Another Korean textile producer - Hi Knit Company Limited – has been recently licensed a project to produce textiles and nonwoven fabric for export and domestic foreign-invested companies in Dong Nai Province.

The domino effect created by foreign expansion in the textile and garment sector has also led to an increase in the number of foreign suppliers of machinery and equipment for the industry. ILLIES Vietnam, a member of German C. ILLIES & Co and a leading distributor of industrial textiles machinery and equipment, for example, also expanded its portfolio in the spinning sector. It now provides machines and spare parts for short-staple yarn-spinning systems for the Rieter Group and the local textile market.

In the first quarter of 2019, ILLIES will also open a repair center for mechanical and electrical parts of Rieter machines.

High export growth

According to Vu Duc Giang, chairman of the Vietnam Textile and Apparel Association, free trade agreements, especially the CPTPP and the EVFTA, are a big motivation to lure foreign investment in Vietnam’s textile and garment industry.

In particular, Giang said, the CPTPP, which will be effective next year, will offer Vietnam a big opportunity to increase textile and garment exports to the bloc’s markets, which is forecast to have a growth rate of 2-3 percent next years and have a total import value of up to US$40 billion per year.

Thanks to the deal, instead of focusing only on Chinese textile and garment products as previously, importers from Canada, Australia and New Zealand are now interested in Vietnamese products. Many of them have come to the country to seek business opportunities and some orders have been signed so far, Giang said.

|

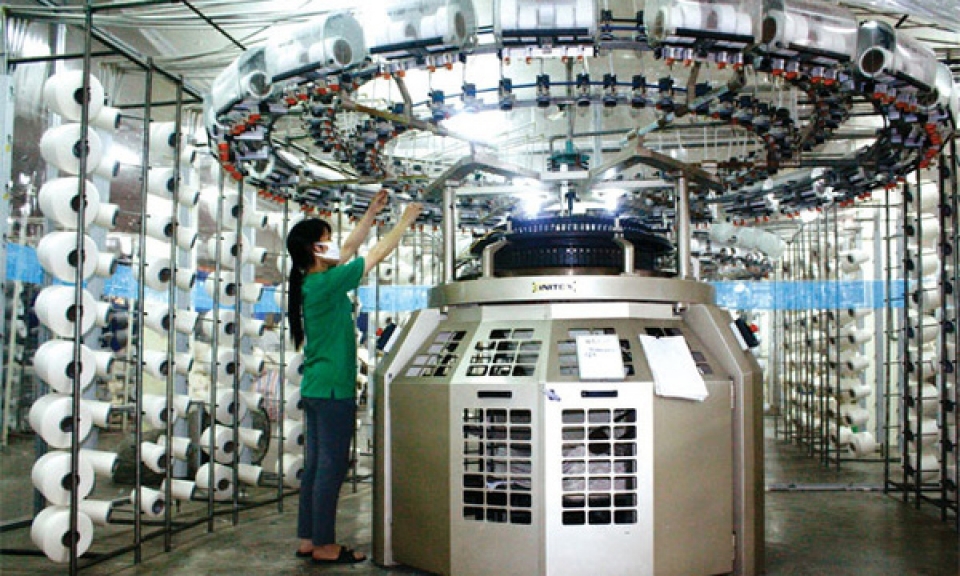

| Foreign firms are investing in garment and textile’s s raw materials production. (Photo: Hanoi Times) |

With the rising demands, Giang forecast the local textile and garment industry will maintain high growth potential until 2035 with an estimated export turnover of about US$200 billion.

He also anticipated the participation of foreign investment in the industry will also help increase the localization rate of raw materials and accessories significantly. The rates of locally produced fiber, polyester fiber and woven fabric are expected to reach 80 percent, 60-65 percent and 50-57 percent by 2035, respectively.

Statistics from VITAS showed that a total of nearly US$15.9 billion in FDI had been injected into more than 2,090 textile and garment projects in Vietnam by the end of last year. In the first half of 2018, the industry attracted another US$2.8 billion in FDI.

| Vietnam, India eye textile cooperation There is a lot of potentials for cooperation between Vietnam and India in the textile and garment sector, a Vietnam-India business meeting heard in Ho ... |

| 200 exhibitors to join Ha Noi Textile, Garment Industry Expo Some 200 local and foreign exhibitors will gather in the 2017 Ha Noi Textile and Garment Industry Expo (HANOITEX) at the International Centre for Exhibition ... |