Vietnam's stocks could be in sweet spot as GDP growth surges

Latest

|

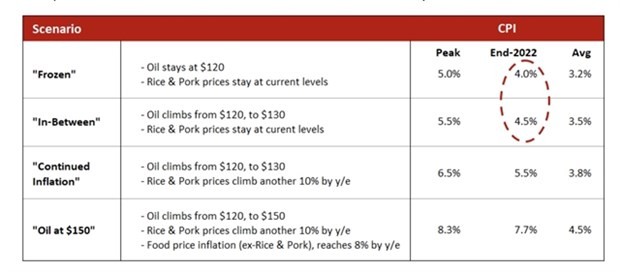

| Table shows a few likely inflation scenarios that VinaCapital has outlined. (Source: VinaCapital) |

“Vietnam’s stellar Q2 GDP growth has prompted us to lift our 2022 GDP growth forecast from 6.5% to 7.5%, although we believe it is very possible [it] will grow by more than 7.5% this year,” Michael Kokalari, chief economist at VinaCapital, said.

“Furthermore, GDP growth in Q3 is likely to exceed 10% year-on-year because the COVID-19 lockdowns [last year] resulted in a low base.

“We believe that a 10% [rate] would be a major catalyst for investors to pour money into Vietnam’s stock market, with the only caveat to the very bright outlook for the country’s GDP growth being the ongoing slowdown in US GDP growth.”

This slowdown in the US economy is weighing on demand for “made in Vietnam” products such as TVs, furniture and smartphones in the country’s largest export market.

Export growth to the US slowed from nearly 50% year-on-year in the first half of 2021 to a still very respectable 23% year-on-year in the first half of this year.

“We expect Vietnam’s export growth to the US to fall to circa 10% by the end of the year as the US economy continues to slow, and we have already been factoring it into our forecasts for Vietnam’s 2022 GDP growth since the beginning of the year.”

Vietnam’s GDP growth accelerated from 5.6% in H1 last year to 6.4% in H1 this year despite the fact that the Government budget surplus more than doubled in the period from 2.2% of GDP to an estimated 5%.

Though this was a major drag on economic growth, it was more than offset by a surge in real retail sales (adjusted for inflation), whose growth increased from 1.9% to 7.9% in the period.

Kokalari said: “Investors are focused on the inflation wave currently sweeping across the globe, but inflation in Vietnam is still very modest at just 3.4%.”

The country’s low inflation rate stems in part from the fact that Vietnam produces more than enough food to feed its citizens.

The recent drop in oil prices should put investors’ minds at ease about the likely trajectory of inflation in Vietnam for the rest of 2022.

The Government cut the environment tax on fuel twice in April and July, reducing pump prices by a total of around 10% though they are still up 40% year-on-year.

Critically, the Government has the room to reduce prices by a further 26%, which would shave off around 1.5 percentage points from Vietnam’s headline inflation, Kokalari said.

Thus, the inflation rate is likely to remain well within the 4% range targeted by the State Bank of Vietnam for this year, making it very unlikely it will hike policy rates in contrast to all of its regional emerging market peers that are currently hiking rates.

Furthermore, the country’s modest inflation has also lent some support to the value of the dong, which has depreciated by only 3% this year despite a 13% increase in the value of the US Dollar/DXY Index.

The surge in domestic consumption propelled the earnings growth of consumer discretionary companies listed on the stock exchange, such as Digiworld (DGW), the consumer electronics/mobile phone retailer, and jewellery retailer PNJ, both of which saw their H1 earnings increase by 50-60%.

With the COVID-19 pandemic essentially over, domestic tourism has surged past pre-COVID levels, and so the earnings of the country’s airport operator, Airports Corporation of Vietnam (ACV), have more than doubled.

Kokalari said: “Unfortunately, Vietnam’s stock market has not benefitted meaningfully from the country’s impressive GDP growth this year, partly because of turmoil in global markets, and there is a risk that global stock market volatility will continue to impact Vietnam’s stock market in the months ahead.

“That said, the consensus expects the market’s earnings to grow by 16% this year, driven by strong economic growth.

“Consequently, we expect a strong rebound in both the VN-Index and our funds by the end of 2022”.