NA Standing Committee agrees on VAT reduction to back socio-economic development

Latest

|

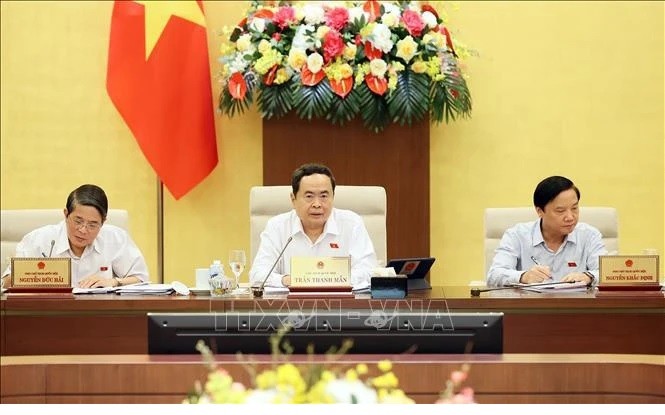

| NA Standing Committee agrees on VAT reduction until year's end: Full-time legislators agree to continue with the 2% VAT tax cut until the end of the year. (Photo: VNA) |

At the 15th National Assembly (NA) Standing Committee's ongoing 34th session, NA Vice Chairwoman Nguyen Thi Thanh stressed that the continuation of the tax incentive from 10% to 8% will boost domestic consumption while motivating enterprises to maintain and develop their production and business.

NA Vice Chairman Tran Duc Hai requested the Government to collect opinions from the committee and inspection agencies to complete the draft resolution on the tax reduction before submitting it to the legislature for consideration.

The Government should work to ensure that the tax cut will not affect the state budget revenue and overspending estimates this year, he added.

At the event, lawmakers also gave opinions on amendments to the bill on the management and use of weapons, explosives and supporting tools, which they said should include specific articles on the management and use of highly lethal knives.