Vietnam: 2022 economic highlights and 2023 outlook

Latest

|

| Vietnam is a shining light across a challenging world economy. Figure 1 shows the change in GDP of number of selected Asian countries. (Photo: DT) |

The year 2022 was a pivotal year for Vietnam along many dimensions of economic activity. The past 12 months started with the resolution of challenges linked to supply chain disruptions, quarantine measures and travel restrictions, lower foreign demand and an uncertain outlook of the COVID-19 pandemic.

Indeed, 2022 was a sort of economic litmus test: Can Vietnam recover to pre-COVID levels of key economic activities? Have Vietnamese companies and managers learnt and implemented some of the lessons the pandemic has taught?

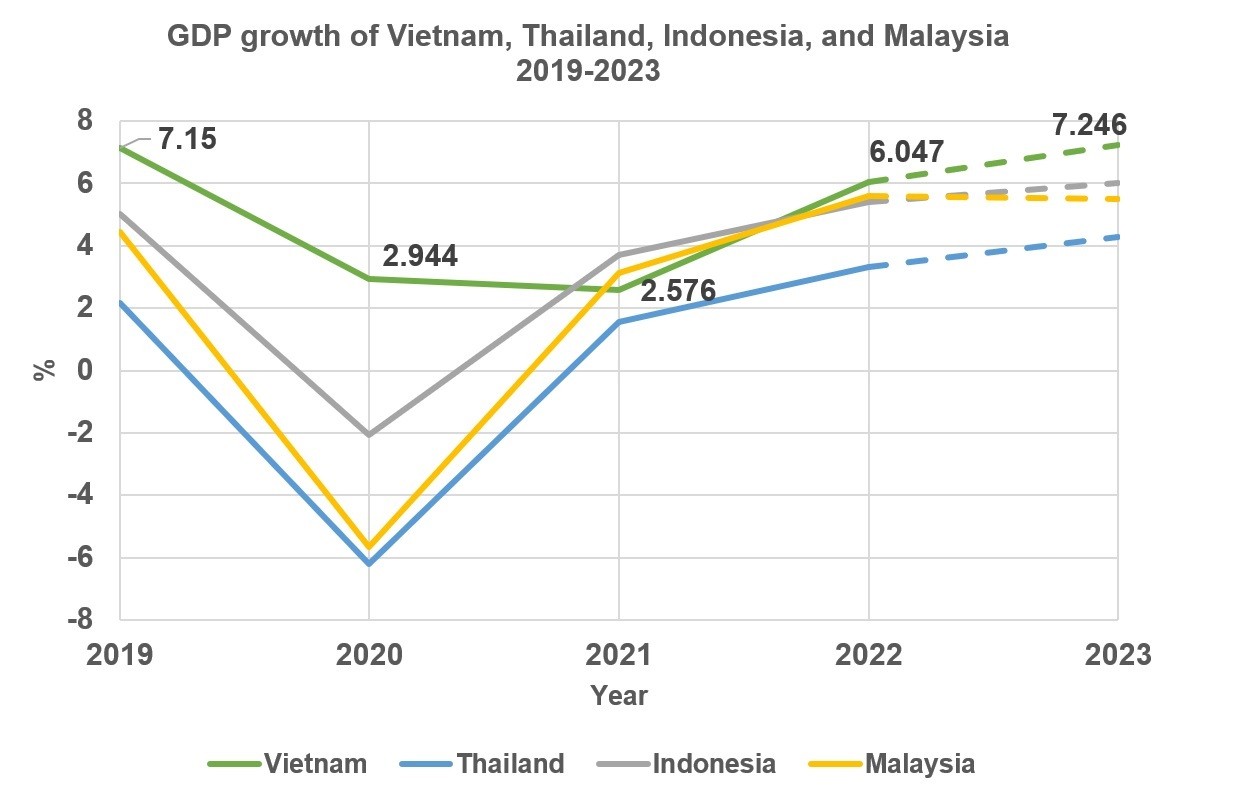

The resounding answer to these questions is “yes”: Vietnam has emerged in 2022 as a stronger, more resilient economy. Businesses across all sectors have become more agile and increased their competitiveness in the region and globally. Indeed, Vietnam is a shining light across a challenging world economy. Figure 1 shows the change in GDP of number of selected Asian countries. It does show that Vietnam not only did well during COVID, but also is outperforming its peers in the region in 2022.

|

| Figure 1. |

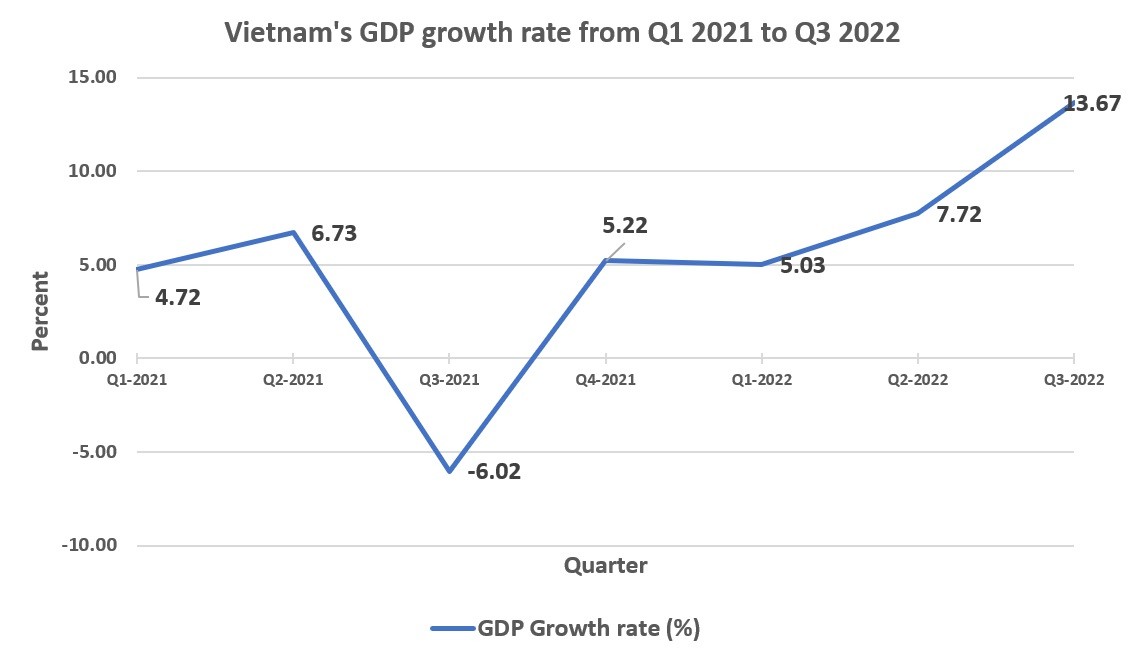

The Vietnamese economy as measured by GDP has expanded by 8.8% during the first 9 months of 2022. The growth has even accelerated throughout 2022, culminating in an increase of 13.7% in the third quarter of this year (Figure 2). This cements Vietnam’s leading position in Asia for the past 12 months and is why the IMF dubbed the country as a “bright spot amid global slowdown”.

|

| Figure 2. |

The strong post-COVID rebound throughout the year was by no means a given. In order to tackle inflationary pressures coming from rising energy costs and increased commodity and food prices, the government has decided over the past months to increase interest rates. Brisk economic growth in high-interest environments is quite a feat: steep borrowing rates are typically associated with lower investments and decreased consumption. Why was Vietnam able to grow in this high-interest and inflationary environment?

Vietnam’s public and private sectors have quickly adopted a living-with-COVID national strategy, easing pandemic restriction for businesses and citizens, and has seen strong credit growth in the first half of 2022.

The government's “Program for Socioeconomic Recovery and Development”, introduced in early 2022, was timely and largely dedicated to developing transport infrastructure, IT, digital transformation, and measures to address climate change. This policy program has not only created employment, but also rendered the very fabric of the Vietnamese economy more efficient, addressing key productivity drivers, such as logistics and digitalisation of businesses and government.

The government’s successful vaccination campaign and a swift return to “business as usual” were key factors that underpinned the quick reopening boom in 2022, as more than 90% of adults are vaccinated, enabling people and businesses to resume economic activities, while paving the way for strong recovery in foreign tourism, manufacturing, and retailing.

Overall economic growth has been largely due to increased household and government spending by 7.3% in the first nine months of 2022, contributing a large portion of the overall growth rate. Increased household consumption signals continued consumer confidence throughout the year, while the policy makers aptly employed a Keynesian-style stimulus policy through an increase in expenditures in public works in order to boost employment, increase jobs, and ensure income in times of a possible recession.

Meanwhile, inflation is kept under control at 3.8%, which is much lower than the rate for emerging economies forecasted at 8.7% for 2022. This lower inflation rate is largely due to ample domestic production and supplies especially in agricultural products providing insulation to the global surge in food prices, as prices for domestic pork, together with a variety of other domestic food products, even declined.

2022 also confirmed an important shift in consumer behaviour. Vietnamese consumers have demonstrated strong willingness to shift their purchases to online sellers; nowadays almost 60% consider online shopping for its convenience. As these newly adopted digital behaviors become permanent habits, e-commerce and all kinds of other digital transactions are expected to continue and play an important role in driving Vietnam’s digital business and digital payment markets.

Perhaps equally important, companies needed to respond to these behaviours by further digitally transforming their processes and even business models. In 2022, we have witnessed the responsiveness by the business community to this “digital imperative” across many sectors.

Vietnam has advanced four places to the number 5 rank in South-East Asia in a recent report about the attractiveness of startup ecosystems. This is partly an early result of the “National Digital Transformation Program” approved in 2020, which surely raised awareness across public and private organisations to implement digital strategies and processes.

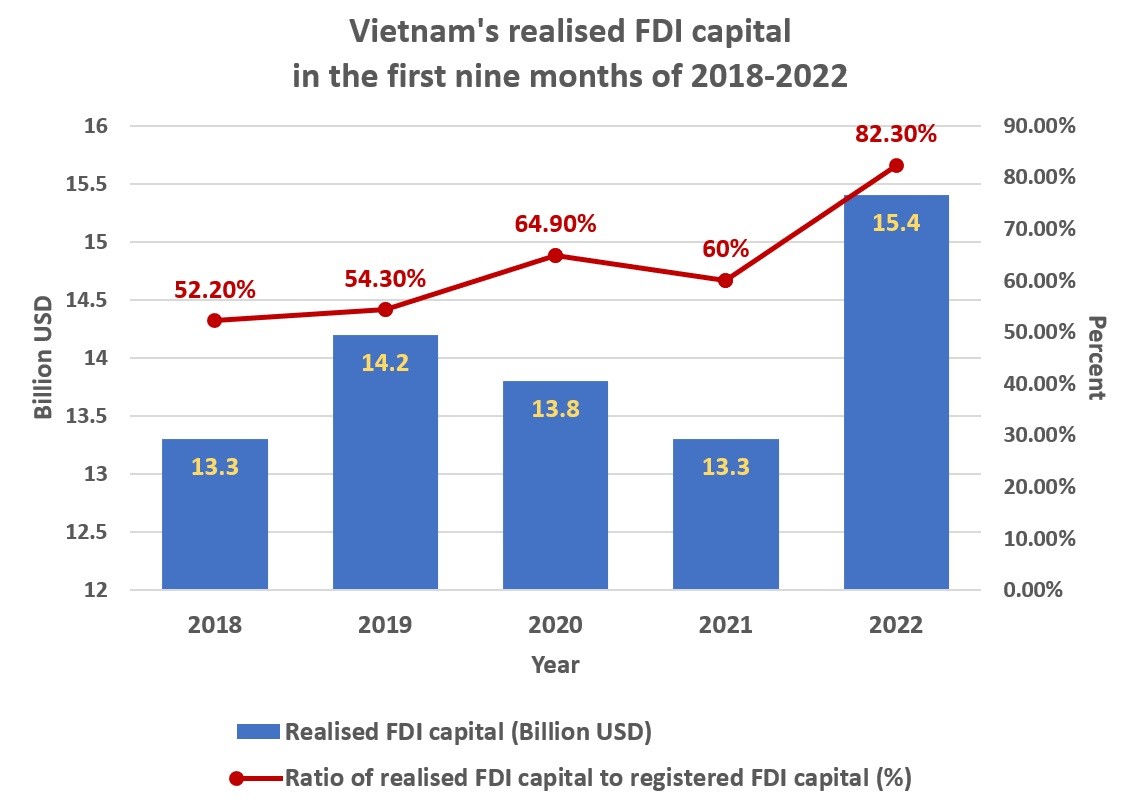

Vietnam achieved a historic record of incoming FDI during the first nine months of 2022, attaining USD 15.43 billion (Figure 3). This even exceeded the pre-COVID high of 14.2 billion USD during the first nine months in 2019. Similarly, the ratio of realised capital to registered capital also increases from 54.3% to 82.3% between 2019 and 2022. The vigorous FDI activity indicate clearly foreign investors’ growing confidence in Vietnam’s socio-economic future.

|

| Figure 3 |

While the high levels of FDI during 2022 are remarkable, perhaps most interesting is the rising proportion of FDI destined to high-tech and high value-added activities. Many observers comment that FDI in complex manufacturing or R&D ventures is a sign that Vietnam is capturing an increased part of global value-added manufacturing. This kind of manufacturing is a key enabler to achieve socio-economic growth over the next decades in Vietnam.

Moving away from highly labour-intensive and low in complexity production (for example, textiles), 2022 has shown strong commitments from Samsung and Apple’s suppliers to Vietnam’s capabilities to upskill its workforce, to comply with global manufacturing standards, and to implement good governance along the supply chain.

A case in point for that migration from labour-seeking to skills-seeking FDIs is the recent announcement by Foxconn, Apple’s oldest and largest original equipment maker (“OEM”) to invest USD 300 million in a new factory in Bac Giang. Foxconn will assemble MacBooks there. Producing these laptop computers requires a more complex supply chain, better trained manufacturing workers, and higher precision machinery than the production of Apple's earbuds that has started in 2020 in the same province.

The recent large investments by Apple’s suppliers, Samsung, Lotte, or also the Danish toy manufacturer Lego signal a whole basket of encouraging news for the future of Vietnam. Surely, these investors will bring money and create employment. In addition, academic studies show clearly that there are other positive spillovers to the whole economy.

For example, workforce and managerial talent gets trained in these companies to global best practices. Some studies demonstrate that foreign firms push domestic companies to become more productive through competitive pressures and increased efficiency.

Also, Vietnam is likely to benefit from examples of increased transparency, better corporate governance and corporate citizenship (ensuring that companies assume social, cultural and environmental responsibilities), in addition to manufacturing methods that have a lower environmental footprint.

2022 was a remarkable year for the whole world. A sharp increase in political risk with armed conflicts in Europe which disrupted fertiliser, wheat and energy markets, went along with significant increases in the volatility of commodity prices and financial markets. In the context of a more uncertain future, Vietnam’s government and businesses are playing their cards well. Being a reliable partner and at the same being agile, is a difficult balance to strike.

One can be optimistic that Vietnam will continue its path to socio-economic success during 2023 and remain largely “uncoupled” from the increased uncertain environment given the positive momentum gathered over the past 12 months. Decision makers, however, may heed Microsoft’s co-founder Bill Gates’s warning: “Success is a lousy teacher; it seduces smart people into thinking they can’t lose”.

* Dr Burkhard Schrage, Senior Lecturer and Program Manager, Management and MBA programs, RMIT University Vietnam

Ms Nguyễn Ngọc Hồng Trâm, Research Assistant, RMIT University Vietnam.